Why invest with us

We want to inspire Canadians to invest in their passions, as well as their financial futures.

Investing is a long-term process. By focusing on the future, you can ride out occasional volatility. Historically, stock markets have rebounded from selloffs, with some of the best days coming on the heels of the worst, so it typically pays to remain invested through volatile times.

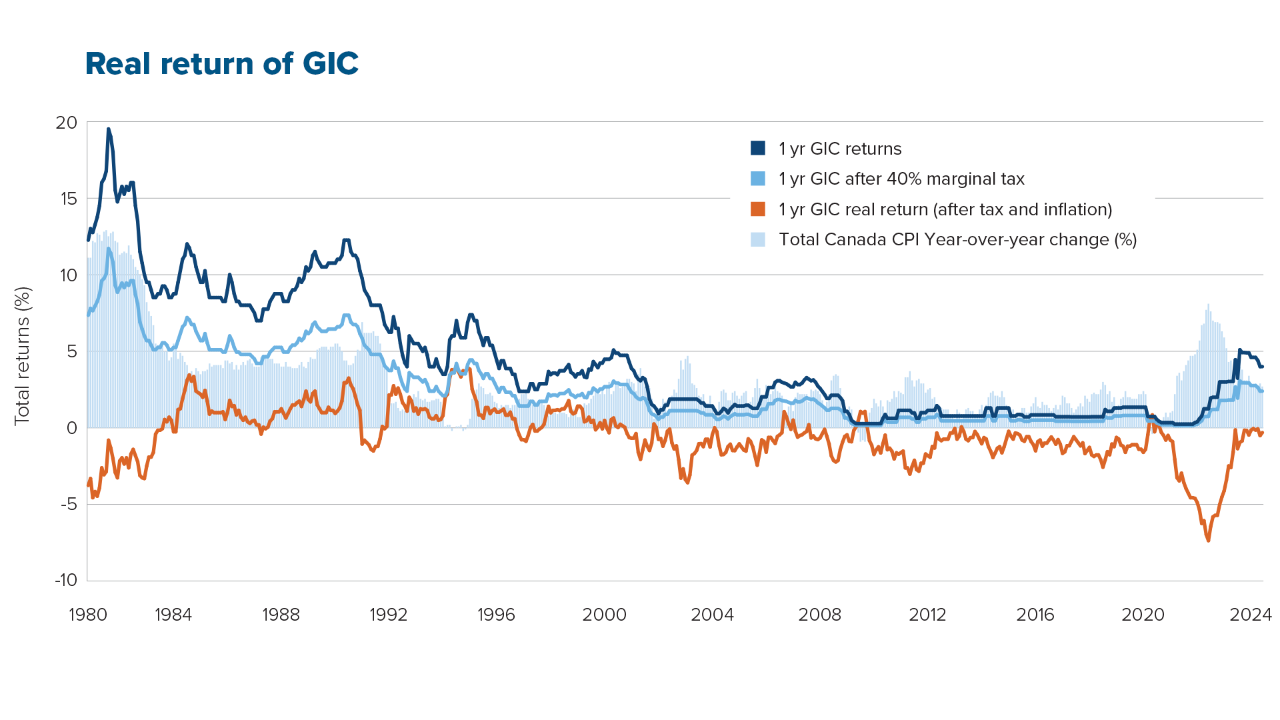

For example, the low-risk profile of a GIC can appear attractive at first glance, especially during volatile markets. However, when you account for tax and inflation factors, the real return of a GIC has often been negative throughout history. When choosing your investment, it’s crucial to evaluate your options through the lens of real return. Sometimes, the low-risk path may end up working against you.

Source: Mackenzie Investments, Bloomberg. As of June 30, 2024. Guaranteed Investment Certificates (GICs) rates reflect average GIC rates from chartered banks. Note: “Real return” reflects nominal return less marginal tax rate at 40% and inflation rate

Source: Mackenzie Investments, Bloomberg. As of June 30, 2024. Guaranteed Investment Certificates (GICs) rates reflect average GIC rates from chartered banks. Note: “Real return” reflects nominal return less marginal tax rate at 40% and inflation rate

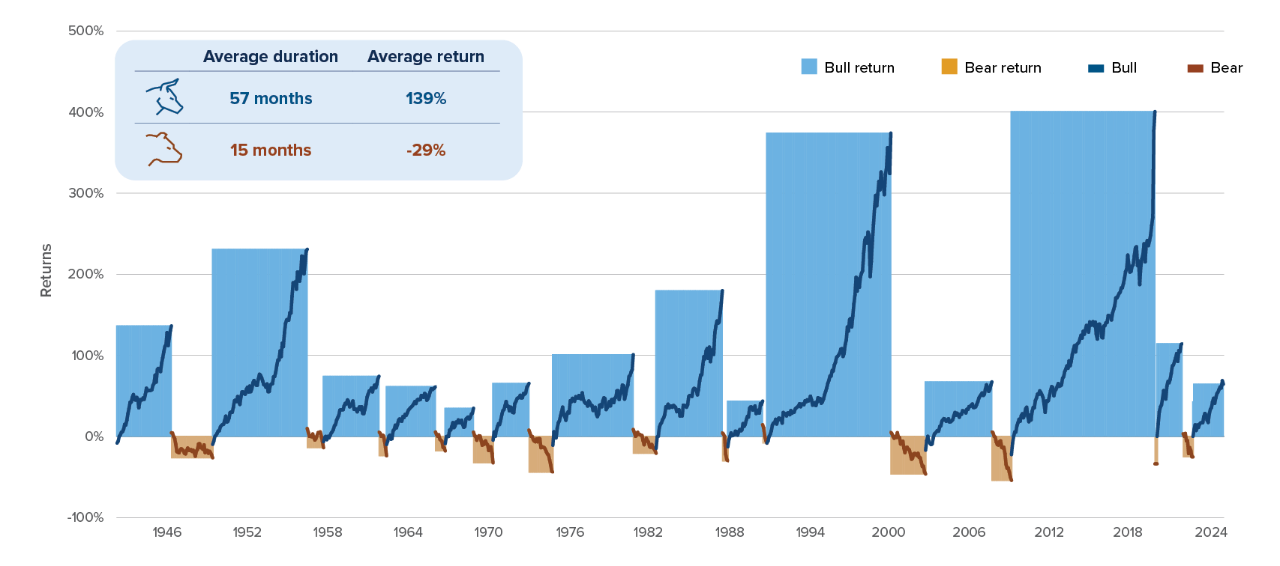

While the stock market can be volatile, the long-term outcome can be far less risky than leaving your money uninvested. Severe declines can be stressful but tend to be short-lived. Historically, the recoveries that follow have tended to last longer, with gains that overshadow the losses.

S&P 500 Index returns

Source: Bloomberg January 31, 2024. Local currency; price only returns, A bull (bear) market is defined as a positive (negative) move greater than 20%.

Source: Bloomberg January 31, 2024. Local currency; price only returns, A bull (bear) market is defined as a positive (negative) move greater than 20%.

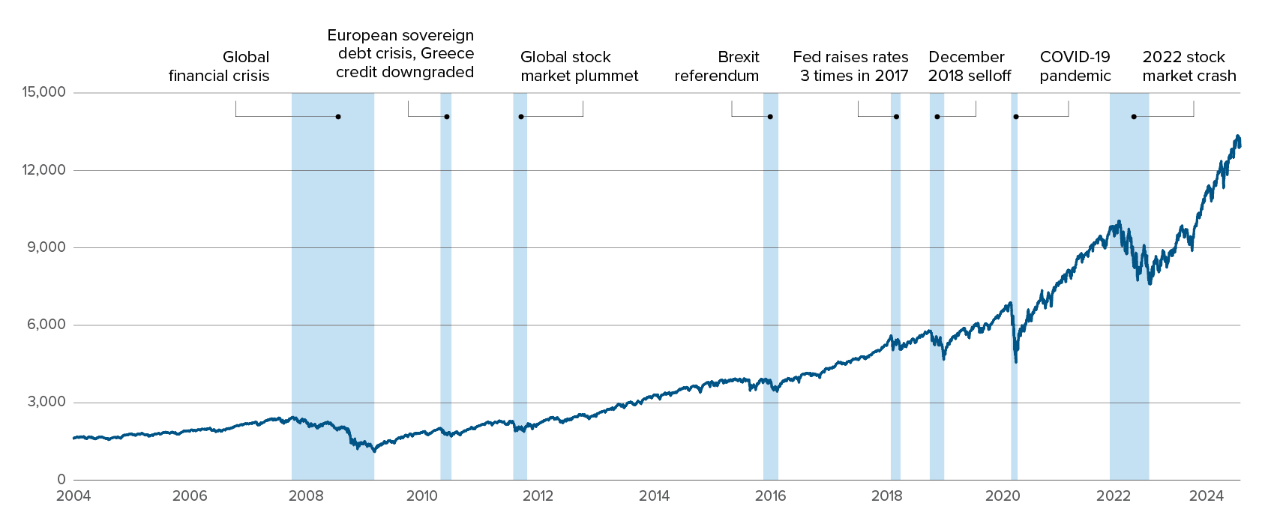

It’s virtually impossible to know when the market has peaked, or when it’s primed to recover. Historically, it’s been best to ride out volatility.

S&P 500 index (USD) – Total return

Source: Morningstar Direct, as at January 31, 2024

Source: Morningstar Direct, as at January 31, 2024

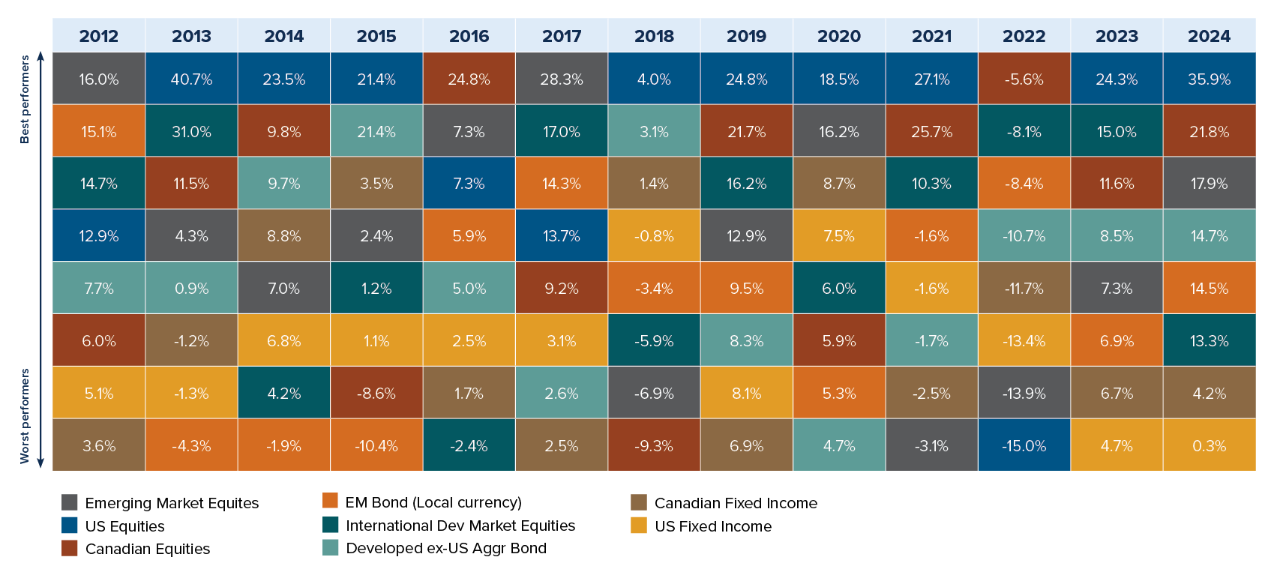

It’s also very difficult to predict which investments will outperform from year to year. It’s usually best to hold a mix of investments that perform differently throughout a market cycle.

Source: Morningstar Direct. All returns calendar annual returns in CAD. Canadian Equities: Solactive Canada Broad Market TR CAD, U.S. Equities: Solactive US Large Cap TR CAD, International Developed Market Equities: Solactive GBS DM ex NA L&M C TR CAD, Canadian Fixed Income: FTSE Canada Universe Bond, U.S. Fixed Income: Bloomberg US Agg Float Adj TR Hedged CAD, Developed ex-U.S. Aggregate Bond: Bloomberg Gbl Agg xUSD 10% IC TR Hdg USD, EM local currency bonds: JPM GBI-EM Global Core TR USD.

Source: Morningstar Direct. All returns calendar annual returns in CAD. Canadian Equities: Solactive Canada Broad Market TR CAD, U.S. Equities: Solactive US Large Cap TR CAD, International Developed Market Equities: Solactive GBS DM ex NA L&M C TR CAD, Canadian Fixed Income: FTSE Canada Universe Bond, U.S. Fixed Income: Bloomberg US Agg Float Adj TR Hedged CAD, Developed ex-U.S. Aggregate Bond: Bloomberg Gbl Agg xUSD 10% IC TR Hdg USD, EM local currency bonds: JPM GBI-EM Global Core TR USD.

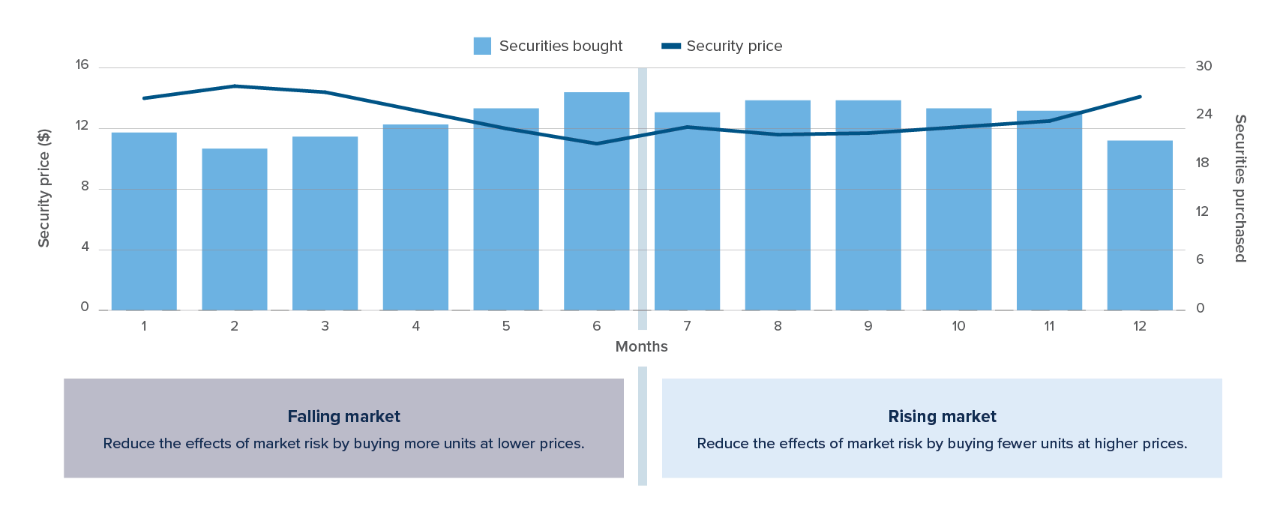

Because it’s so difficult to know when to buy or sell an investment, it can be a good idea to invest frequently. This can remove the emotional element of investing so you can take advantage of periodic downturns when the markets are “on sale”. To take advantage of these changing prices, one effective investment strategy is dollar-cost averaging (DCA).

This hypothetical illustration shows how investing $300 each month in a fluctuating market can potentially help reduce the overall cost of the portfolio by buying more securities when the price is lower and fewer when the price is more expensive. For illustrative purposes only.

Periods of extreme volatility can be sparked by dramatic world events, which can add to the emotional toll of a falling portfolio. Yet even the most traumatic world events have not had a lasting impact on the market.

The most important thing to remember is that, historically, the markets eventually recover from their selloffs — it’s about time in the market, not timing the market. A moment of crisis may undercut the market, but innovation and economic growth are the true drivers of investment returns.

Unlike mutual funds, the returns and principal of GICs are guaranteed.

1 Bank of Canada. March 11, 2021. Source: COVID-19, savings and household spending - Bank of Canada.

2 Morningstar’s ESG Indexes Have Outperformed and Protected on the Downside.

3 Cirano Research Study, March 2020. In 2018, the average household with a financial advisor for 15 years or more had asset values 2.3 times higher than an average “comparable” household without a financial advisor. This number varied between 2.73 in 2010 and 2.9 in 2014.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this web page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Mackenzie Investments head office is located on the home and traditional lands of many nations including the Mississaugas of the New Credit, the Anishnabeg, the Chippewa, the Haudenosaunee, the Huron and the Wendat peoples and is now home to many diverse First Nations, Inuit and Métis peoples. Our clean drinking water comes from Lake Ontario. We are grateful to have the opportunity to work in this community and also recognize our employees working from places, near and far, acknowledging the traditional owners and caretakers of those lands.