Written by the Mackenzie Betterworld Team

Portfolio and Sectors review

The Mackenzie Betterworld Global Equity Fund slightly underperformed its new benchmark (MSCI World ex Fossil Fuels Index) for the month. Stock selection in financials and utilities detracted most from portfolio performance while stock selection in consumer staples and materials contributed positively to help offset portfolio underperformance.

Veolia Environnement, a French water, energy and waste recycling management services company, was negatively impacted by French politics sentiment over the month resulting in it’s share price falling by around 7.6%. On the fundamental front and in the team’s view, Veolia’s earnings resilience remains underappreciated by the market. Around 50% of it’s EBITDA comes from infrastructure-like activities and approximately 80% of it’s EPS growth up to 2027 is expected to come from synergies and cost savings. This puts the company in a favorable financial position for the upcoming years. Another team’s holding ING Groep, reported mixed Q3 results as lending margins soften over the period. In the team’s view, ING remains one of the more attractive capital return stories in the sector with expectations that over the next three years the bank can return more than 40% of its market cap. On a positive note, Darling Ingredients stock price was up over +11% for the month. The team believes that earnings will benefit from continued demand growth for feedstocks from the biofuels industry. Additionally, the elevated capex cycle for the Diamond Green Diesel joint venture is expected to wind down and be reflected in the company financial statements.

The Mackenzie Betterworld Canadian Equity Fund slightly underperformed its new benchmark (S&P/TSX Composite Fossil Fuel Reserves Free Index) in November. Stock selection in financials and utilities detracted most to fund’s performance. Team’s holding in independent power producers (IPP’s) Boralex, Innergex and Northland Power sold off following the U.S. elections as negative sentiment towards the renewable energy space resurfaced. The team remains optimistic on the space for the following reason:

- Across Canada, request for proposals (RFP’s) for new power generation and storage are being issued to supply increased electricity demand projections driven by data centers, electrification, reshoring of production and population growth. Power demand could grow by 50 to 100% over the next couple of decades, following a period with little investments over the last 15 years.

- The Betterworld team in conjunction with street analysts believe that further sector consolidation should occur in this space, as private capital seeks out value in infrastructure platforms. IPPs will continue to search for a lower cost of capital given the significant growth opportunities enumerated above and be constructive of the larger players we hold.

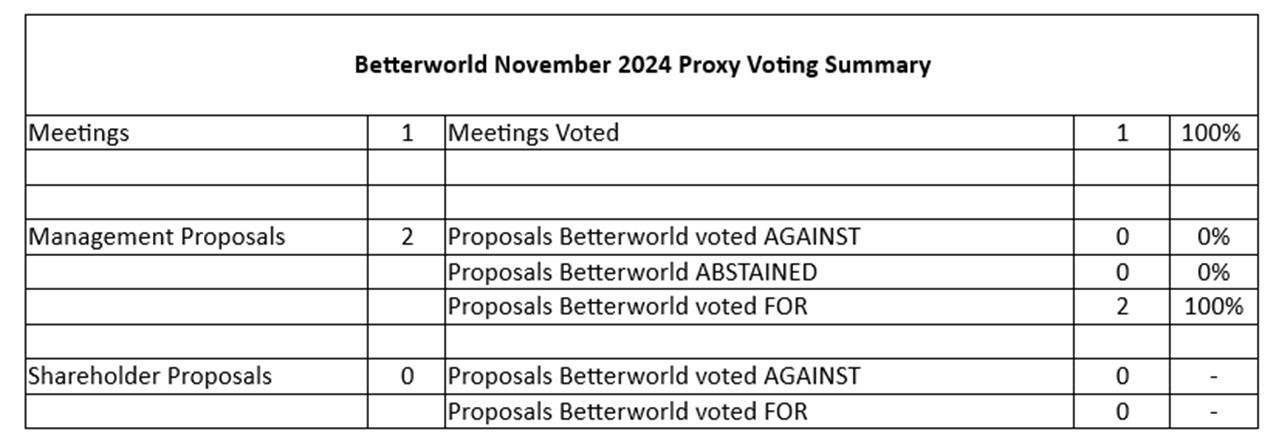

Proxy Voting

The Betterworld team participated via proxy in one company meeting in November with North American water solutions provider, Primo Water. The meeting was called to vote on the merger between Primo Water and private water distribution firm Blue Triton. Primo Water shareholders will own approximately 43% of the newly formed Primo Brands total fully diluted issued share capital, with current BlueTriton shareholders holding the remaining 57% pro forma equity stake.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) are not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third-party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of November 30, 2024. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. Mackenzie Investments, which earns fees when clients select its products and services, is not offering impartial advice in a fiduciary capacity in providing this sales and marketing material. This information is not meant as tax or legal advice. Investors should consult a professional advisor before making investment and financial decisions and for more information on tax rules and other laws, which are complex and subject to change.

©2024 Mackenzie Investments. All rights reserved.