What is the interval fund?

Interval funds are designed to offer retail investors access to an attractive mix of liquid and illiquid investments. While institutional investors and high net worth investors have embraced illiquid investments – also known as private markets – retail investment continues to lag due to limited accessibility and large investment minimums.

Unlike mutual funds, which may be purchased daily, interval funds are only available for purchase at specified intervals, typically monthly.

Also, while mutual funds typically provide daily redemptions, interval funds provide limited liquidity to unitholders via repurchase offers – typically for 5% or more of a fund’s outstanding units at net asset value (NAV)* – using its liquid assets. The objective of the repurchase limit is to reduce the forced sale of illiquid assets at undesirable prices for the benefit and protection of remaining investors.

We are pleased to offer the Mackenzie Northleaf Private Credit Interval Fund, Canada’s first interval fund. The fund provides exposure to private credit in a vehicle accessible to all investors.

* The NAV represents the per share/unit price of the fund on a specific date or time

Canada’s first interval fund makes private credit accessible to all investors. Find out what Mackenzie’s interval fund is and how it works.

How does our interval fund compare to mutual funds and privately offered funds?

There are several distinctions and similarities between the Mackenzie Northleaf Private Credit Interval Fund (MNPCIF), traditional mutual funds and privately offered funds available via an offering memorandum. These are set out below:

|

Traditional mutual fund |

MNPCIF |

Privately offered funds |

Offering document |

Simplified prospectus |

Simplified prospectus |

Offering memorandum |

Investor types |

Retail investors |

Retail investors |

Accredited investors |

Valuation frequency |

Daily |

Weekly (indicative only) monthly (transactional) |

Typically monthly or quarterly |

Subscription frequency |

Daily |

Monthly |

Typically monthly or quarterly |

Repurchase/redemption frequency |

Daily |

Quarterly |

Typically monthly or quarterly |

Repurchase/redemption limit |

n/a |

Up to 5% of NAV |

Typically 5% – 20% of NAV |

Minimum initial investment |

Typically $500 |

$5,000 |

Accredited: Variable but typically $5k – $25k Non-accredited: $150k |

Illiquid asset restriction |

Up to 10% |

35%-65% (target), with buffer up to 90% |

n/a |

How does our interval fund’s purchases and repurchases work?

Purchases

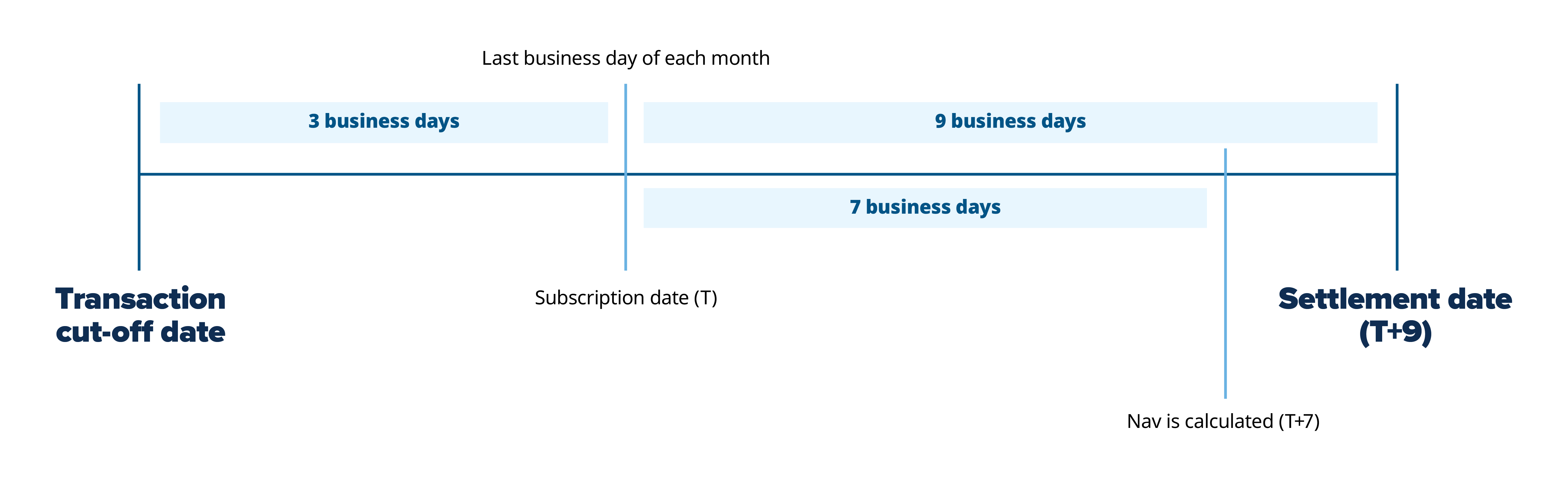

While traditional mutual funds can be purchased daily, units of MNPCIF are only available for purchase on a monthly basis at current NAV. Purchases are processed as of the last business day of each month (the subscription date) and orders must be received by Mackenzie at least three business days (the transaction cut-off date) prior to the relevant subscription date.

The timeline below outlines the three distinct dates for purchases:

Transaction cut-off date: The last day subscriptions must be received by Mackenzie to be accepted for a specific subscription date

Subscription date: The subscription NAV will be calculated effective on the last business day of each month

Settlement date: The day units are issued to investors

Repurchases

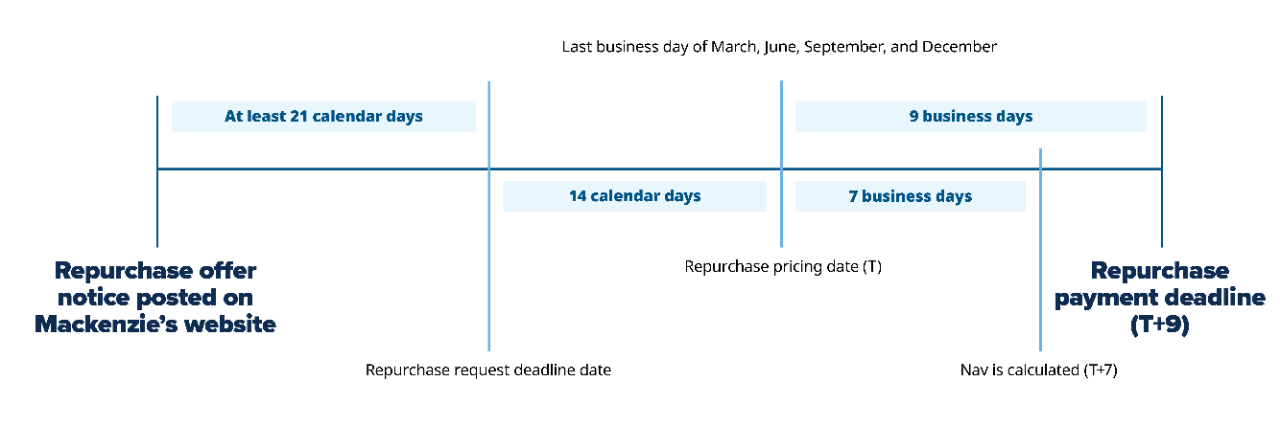

To provide some liquidity to unitholders, MNPCIF will conduct quarterly repurchase offers (which are effectively similar to redemptions) for 5% of the outstanding units at NAV. If repurchase requests exceed MNPCIF’s repurchase limit, repurchases will be allocated to investors on a pro-rata basis. Hence, investors may not be able to sell units when and/or in the amount desired.

The timeline below outlines the four distinct dates for repurchases:

Notice of repurchase offer: The day unitholders are notified of a repurchase offer for a specific repurchase pricing date. Unitholders are notified by Mackenzie posting the applicable repurchase offer notice to its website

Repurchase request deadline date: The last day the repurchase tender form must be received by Mackenzie for a specific repurchase pricing date

Repurchase pricing date: The repurchase NAV will be calculated effective on the last business day of each quarter

Repurchase payment deadline: The day repurchase proceeds are paid to investors

Potential benefits of interval funds

- Interval funds are sold via prospectus, which requires far less paperwork than a fund sold via offering memorandum.

- Interval funds allow retail investors to gain access to illiquid assets that may provide a range of potential portfolio benefits, including reduced volatility, enhanced yield and higher returns.

- Compared to offering memorandum funds, interval funds have much lower minimum investment requirements that are similar to mutual funds. They also provide easier access to invested capital than traditional privately offered funds.

Potential risks of interval funds

- Interval funds are best suited to investors with long-term time horizons who are comfortable with limited liquidity.

- Typically, interval funds offer to repurchase 5% or more of a fund’s outstanding units at NAV on a quarterly basis. As a result, liquidity is neither guaranteed nor as readily available as with mutual funds or ETFs.

- There is no guarantee that investors will be able to sell as many units as they wish per a given repurchase offer, as the number of units tendered may exceed the number of units a fund has offered to repurchase. Unitholders may have to wait until subsequent repurchase offers to have the remainder of their request filled.

Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the Prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The Mackenzie Northleaf Private Credit Interval Fund (the “Fund”) is offered to retail investors by way of prospectus, annual information and fund facts. The Fund is a non-redeemable investment fund in continuous distribution that is structured as an ‘interval fund’. Interval funds differ from mutual funds in that investors do not have the right to redeem their units on a regular, frequent basis. The Fund is only available through IIROC licensed dealers/advisors.

An investor should carefully consider whether their financial condition and investment goals are aligned with an investment in the Fund. The Fund will invest primarily in (i) illiquid private credit instruments on an indirect basis through investments in one or more Northleaf Private Credit Funds and (ii) public securities and other debt instruments on an indirect basis through investments in exchange traded funds.

The legal offering documents contain additional information about the investment objectives and terms and conditions of an investment in the Fund (including fees) and will also contain tax information and risk disclosures that are important to any investment decision regarding the Fund. An investment in the Fund is suitable only for long-term investors who can bear the risks associated with the limited liquidity of the units. An investment in the Fund is not intended as a complete investment program. Investors should consult with their financial advisor to determine the suitability, and appropriate allocation, of the Fund for their portfolio. This document does not constitute legal, tax, investment or any other advice. Prospective investors should consult with their own professional advisors regarding the financial, legal and tax consequences of any investment.