Guide to Exchange Traded Funds

What are exchange traded funds?

Exchange traded funds (ETFs) are one of the fastest growing investment products in the world, offering investors an alternative solution to enhance portfolio diversification, flexibility and liquidity.

ETFs can be bought and sold on an exchange like individual stocks. They can contain a portfolio of securities designed to track a specific index, market sector or even cover the broad market. This flexibility means investors can use ETFs to gain the exposure and diversification they want, quickly and simply.

-

Features of ETFs

Diversification

By aiming to replicate a specific basket of securities, such as an index, an ETF aims to incorporate all, or a representative sample of, the securities that make up that basket. This may reduce the impact that volatile markets may have on the portfolio from rising and falling prices, especially when compared to the group of individual securities.

Liquidity

ETF shares trade like common stocks on the stock exchange. As such, they are an ideal solution for investors who wish to get into and out of investment positions with minimum risk and expense.

Flexibility

Similar to stocks, ETFs can be bought and sold throughout the trading day on a stock exchange at market determined prices. This offers the ability to act on information quickly and efficiently.

-

Types of ETFs

As the popularity of ETFs has grown, so has their complexity.

Passive (Beta)

- Classic Beta (S&P 500 S&P/TSX 60)

- Style Beta (Russell 2000 S&P 500 Value)

Passive ETFs track a corresponding index. They do not try to outperform that index, but simply replicate its performance. Unlike actively managed ETFs, passive ETFs are not managed by a fund manager on a daily basis.

Smart Beta

- Single Factor (Dividend, Low Volatility)

- Multi-Factor/ Alternatively Weight (Fundamentals)

- Access (Commodity, Sr. Loans)

Smart beta defines a set of investment strategies that emphasize the use of alternative index construction rules to traditional market capitalization based indices. Smart beta emphasizes capturing investment factors or market inefficiencies in a rules-based and transparent way.

Active (Alpha)

- Alpha (PM Managed)

- Alpha (Quantitative)

Active ETFs have a manager or investment team making decisions on the underlying portfolio allocation – they do not follow a passive investment strategy. Active ETFs do attempt to outperform a benchmark and/or manage volatility and portfolio risk.

-

Liquidity of ETFs

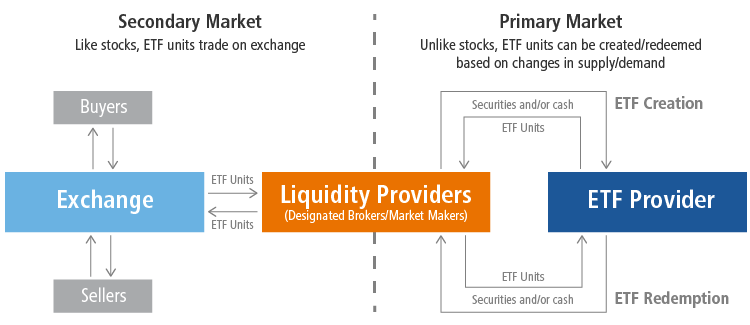

An attractive feature of ETFs is their ability to be traded throughout the day. The key to a smooth, profitable trading experience is liquidity. The true liquidity of an ETF is represented by the liquidity of the underlying securities and is a function of the creation and redemption process.

In general, creation and redemption of units are facilitated by “authorized participants” (APs), such as a designated broker or market maker who interacts with the fund in large blocks of units, typically 50,000 or 100,000 units. When the ETF wants to create new shares, it turns to the AP to help provide liquidity in the form of more shares to offer in the market. The ETF provider interacts directly with the AP in what is called the primary market.

APs can also remove ETF shares from the market. An AP can buy a block of ETF shares on the open market and transfer them to the ETF provider for the value of their underlying securities (in cash and/or securities).

This mechanism facilitates the primary market in ETFs and works through the in-kind transfer of a basket of securities, or the transfer of cash, to (or from) the fund.

The Creation Redemption Process

This creation redemption process performs important functions:

It creates liquidity for the ETF shares by meeting the supply and demand needs of investors who trade on an exchange (also known as the secondary market).

It helps keep an ETF’s market share price consistent with the fund’s NAV.

Analysis of trading activity in an ETF needs to be viewed in the context of the liquidity of the underlying securities it holds. This creation and redemption process is the unique conductor of liquidity between the ETF and its underlying assets.

-

Understanding ETF Premiums and Discounts

One of the many benefits of Exchange Traded Funds (ETFs) is the fact that the price of ETF units generally reflect the market value of its underlying basket of securities.

Understanding Market Price vs. Net Asset Value

ETFs trade on stock exchanges, and have two end-of-day values. The first is a closing market price, which is determined by trading activity on the exchange throughout the day. This reflects the price at which the units last traded during the trading session. Alternatively, it can reflect the midpoint of the bid and ask quotes if the ETF does not trade during that trading session. The Net Asset Value (NAV), which is calculated after the market closes, is the weighted-average price of the ETF’s underlying holdings, net of expenses such as management fees, divided by the units outstanding.

The closing market price refers to the official price set by the exchange on which the ETF trades, as a result of trades during the closing auction. Although the closing price is often close to the NAV, it may be different. In highly volatile markets, this difference may be exaggerated.

What is a Premium or Discount to NAV?

A premium or discount to the NAV occurs when the market price of an ETF rises above or below its NAV. If the market price is higher than the NAV, the ETF is said to be trading at a premium. If the price is lower, it is trading at a discount.

Drivers of ETF Premiums and Discounts

Two key factors can drive premiums and discounts:

If the underlying securities trade on an exchange that is open at a different time than the exchange the ETF trades on, there could be deviations between current and stale security pricing, resulting in larger premiums or discounts.

If the underlying securities become less liquid or markets are experiencing heavy order flow, the result may mean higher transaction costs, leading to larger premiums and discounts.

Many ETFs, notably domestic equity ETFs, have smaller premiums and discounts since they trade at the same time as their underlying market, which is also very liquid.

Many ETFs track well known indices and their daily closing price, reported by multiple data providers such as Bloomberg or Thomson Reuters, quote the price at which units last traded during the trading session. For ETFs that don’t trade frequently throughout the day, the quoted last price traded may not correspond to the daily change in the value of the ETF’s underlying index or basket of securities. This might lead an investor to mistakenly conclude that an ETF is trading at a premium or discount to its NAV.

Market Makers and their Role

Market makers provide liquidity by facilitating trades in the secondary market. Through adjusting for continuous market movements in the ETF’s underlying securities, market makers set intra-day bid and offer prices for the ETF. While any market participant may meet the best bid or best offer at a given time, a market maker ensures that there is always a bid and offer quote at which to trade. The majority of Canadian-listed ETFs generally trade with a tight bid/ask spread on either side-of NAV, regardless of how frequently they trade. A tight bid/ask spread is facilitated by the presence of a market maker, a designated broker-dealer firm that tracks an ETF’s NAV throughout the trading day. As supply and demand pushes an ETF away from its fair value, market makers arbitrage the deviations by selling the ETF at a premium, and buying shares at a discount, to maintain a tight bid/ask spread close to the NAV.

Typically, demand is a major determinant of premiums or discounts, since strong demand would make the ETF price rise quickly above its NAV, causing a premium, or low demand may allow the underlying securities to appreciate above the ETF’s price, causing a discount. The imbalances between supply and demand are particularly noticeable within illiquid markets that offer limited access to the underlying assets, such as in the emerging markets. Additionally, international ETFs also track securities traded on different time zones, which produces a time lag to between the ETF and its NAV. Commodity ETFs may be restricted by position limits on futures contracts and trade at a steady premium to underlying commodity prices.

In large liquid markets, market makers tend to take advantage of the ETF arbitrage system to capitalize on any discounts or premiums as they create or redeem shares to bring the ETF price closer to the NAV.

-

ETF Trading Best Practices

Exchange Traded Funds (ETFs) continue to gain popularity amongst investors of all types. They offer investors diversification, liquidity and flexibility, as well as access to smart beta, active and passive strategies. As ETFs trade on an exchange like stocks, there are a few simple strategies you can employ to seek the best trade execution for your clients.

1. Use limit orders to seek a balance between timely execution and price

Buy ETFs using limit orders:

A client wants to buy X shares of this ETF, but doesn’t want to pay any more than Y dollars per share.

Use a limit order to specify a price equal to or greater than the ask price (but not more than what you want to pay). This order increases the likelihood that your trade will be made and avoids the risk of the client paying more than desired.

Sell ETFs using limit orders:

A client wants to sell X shares of this ETF, but doesn’t want to receive less than Y dollars per share.

Use a limit order to specify a price equal to or less than the bid price (but not less than what you want to receive). This order increases the likelihood that your trade will be made and avoids the risk of the client receiving less than desired.

2. Key Differences Between Market and Limit Orders:

Market Orders:

Buy or sell right away at the best available current price. Priority is fast execution, not securing a certain price.

Considerations:

No upper/lower limit on the price the trade could be made at, meaning you could pay more than you wanted.

Limit Orders:

Use to set a target execution price. Priority is securing a certain price, not fast execution.

Considerations:

Your trade may not be executable at the specified price, or only partially executed, requiring an additional trade at a modified price to completely fill the order.

3. Keep an eye on market volatility

In times of market volatility there is a widening in ETF bid/ask spreads – the difference between what ETF sellers are prepared to accept and what ETF buyers are willing to pay. Premiums or discounts of the ETF’s market price relative to the net asset value (value of the underlying securities) may also occur. In these environments, seeking trading assistance and using limit orders may be advisable.

4. Focus on historical spreads and not only recent trading volume

A common misconception is that an ETF’s average daily trading volume alone determines its liquidity. In reality, the best measure of an ETF’s liquidity is determined by the liquidity of its underlying securities. An ETF’s bid-ask spread is a preferred measure of liquidity because it includes the liquidity of its underlying securities and the costs associated with the creation/redemption process.

5. Look at bid/ask prices to gauge the current market price

Current bid and ask prices are a better measure of the fair value of an ETF as they are representative of the basket of securities in the ETF itself. You should note, however, that the market maker bid-ask may not be the highest bid or lowest ask (also known as “top of book” bid-ask). Rather, the market maker bid-ask spread serves as a range to manage the price of the ETF. Using the last traded price can be problematic as the market environment may have changed and the data may be stale.

6. Time can be a factor for international ETFs

ETFs which trade in Canada and the U.S. can be constructed in whole or part from international securities. International markets in which these securities trade, may be closed when North America is open for trading. When those markets are closed information continues to flow that may affect the security prices which contribute to the ETF price. It is the responsibility of the market makers to make adjustments to the ETF price during North American trading hours to reflect the new information. The market maker’s ability to make these adjustments is aided by proxy securities, but is most accurate if or when the international market is open and trading and overlaps with North American market hours. Therefore it may be preferable to trade the ETF during the trading hours of the underlying securities if possible.

7. Considering the size of the trade

When looking to place large trades of an ETF at a particular time of day, you may not get the best price by executing the transaction online, even by using a limit order. You may also face higher trading costs. In these situations, you can either contact your brokerage platform directly or Mackenzie Investments, the ETF provider, for assistance.

-

Dispel ETF Myths with ETF Realities

Myth 1: Low ETF trading volumes and assets under management (AUM) translate into low liquidity

Reality:

An ETF can have low trading volume and low AUM yet still have high liquidity. Similar to a mutual fund, an ETF’s liquidity is not established by its trading volume but by its underlying holdings. On the minimum, an ETF or mutual fund will be as liquid as its underlying holdings.

It is also important to remember that ETFs are fundamentally different than individual stocks that trade on an exchange. This difference can have a meaningful impact on liquidity. Unlike stocks, which typically have a fixed amount of shares outstanding, ETFs are open-ended investment vehicles (similar to open-ended mutual funds). ETFs are able to issue new shares or withdraw existing shares in the market to meet investor supply and demand. This helps explain why metrics like AUM or trading volume are not helpful in estimating liquidity of an ETF.

An ETF that invests in large companies will have relatively higher liquidity as these stocks trade millions of shares daily. On the other hand, ETFs that invest in less liquid stocks or in securities that trade over the counter (OTC) may experience relatively lower liquidity, which may increase price swings. This would be no different within a mutual fund structure.

An advisor should evaluate an ETF’s underlying holdings to determine liquidity, not its trading volume or AUM. If there is no liquidity concern with a mutual fund that invests in similar securities as an ETF, there should be no concern with regards to liquidity in an ETF.

Volume is not indicative of liquidity – regardless of the fund structure.

Advisors sometimes also attempt to evaluate an ETF’s liquidity by reviewing exchange order books, which reflect price and number of shares available. However, market makers only reflect a fraction of the volume they are willing to trade in an ETF. They do so to better manage risks associated with significant market movements through the day.

Myth 2: Secondary market ETF liquidity is entirely reflected on screen

Reality:

Market makers only display a fraction of the volume they are willing to trade. Investors access ETF shares through the secondary market (e.g., stock exchanges) so it is understandable that investors assume that what they see is the total volume available to trade. However, ETFs are unique from stocks and mutual funds in that market makers can add new ETF shares into circulation or take shares out of circulation via the primary market. They do so by working with the ETF provider (i.e. Mackenzie Investments). This process helps keep the price of the ETF close to the ETF’s underlying net asset value (NAV).

Myth 3: Mackenzie ETFs have wide spreads

Reality:

The spread of an ETF represents the spread in the underlying asset class, plus the costs, risks and Profit & Loss for the market maker. The spread seen on screen is two-way. The ETF is typically trading with the NAV at mid-point of the bid and offer prices. This means that the spread actually being experienced to buy in or sell out of ETF shares is half that of the total spread reflected on screen.

The transparency offered by ETFs allows investors to see these costs in real time. In comparison, within a mutual fund, the portfolio spread would look in line with a similar ETF, but the mutual fund structure does not provide this level of intraday transparency.

ETFs that invest in more liquid asset classes tend to have tighter spreads than ETFs that invest in less liquid segments of the market. Geography can also have an impact. Trading stocks or bonds in North America may come at a tighter spread as opposed to trading outside of North America. Higher levels of secondary market trading may have further impact to the tightness of spreads.

Bid/ask spreads should be of less concern to long-term investors as spreads are only incurred when purchasing or selling ETF shares.

Myth 4: ETFs are more risky investments than mutual funds

Reality:

There is no notable research that demonstrates that ETFs are riskier than mutual funds. The risk or volatility associated with any fund structure, whether ETF or mutual fund, is influenced by various factors.

The following factors can impact the perceived risk or volatility of an ETF or mutual fund:

- Performance characteristics of the underlying securities

- Inherent risk and volatility in the markets within which the ETF or mutual funds invests

- The manager’s investment style and strategy

Myth 5: Trading at a premium or discount to the NAV is a shortcoming of the ETF mechanism

Reality:

The fact that ETFs are designed to transact both in the primary market (creating and redeeming shares at net asset value, or NAV) and on an exchange at prices established by the secondary market is a benefit and allows investors to access realtime market prices when trading. The existence of both a primary and secondary market increases overall pricing efficiency and enhances liquidity.

Myth 6: ETFs are only for day traders and short-term investors

Reality:

Like mutual funds, ETFs are effective tools for building portfolios for investors. While ETFs are often used by active investors as trading vehicles, they can be used effectively as buy-and-hold investments for long-term investors.

Whereas one investor may purchase a particular ETF to hedge, another may buy the same ETF for a completely different strategy, such as to grow capital. The product design of ETFs allows investors with similar or different investment objectives to own the same product and still accomplish their respective goals.

Myth 7: All ETFs replicate their underlying indexes

Reality:

Most, but not all, ETFs are designed to provide investment results that generally track the performance of an underlying benchmark index by holding a portfolio of securities that mirror this performance. The majority of ETFs around the world use one of three techniques to achieve this goal: full replication, optimization-based tracking and synthetic replication. However, not all ETFs are replication-based and a growing number of actively-managed ETFs have been launched that leverage the expertise of portfolio managers to execute security selection and trading decisions.

Full Replication

In this approach, an ETF holds all of the securities in the same weightings as its associated index. Over time, the manager adjusts the portfolio to reflect changes in the index and manages cash flow from dividends or income generation. This strategy tends to provide very close tracking with the underlying index.

Optimization-Based Tracking

This strategy is designed to control trading costs and promote liquidity. It uses a sampling process to create a representative or optimized portfolio of securities that closely matches the characteristics of the underlying index. While this approach may be more cost-efficient, it tends to carry a higher potential for tracking error than ETFs that use full replication.

Synthetic Replication

These ETFs attempt to replicate index returns by purchasing derivatives such as swap agreements with one or more counterparties, such as a bank. Typically, the counterparty will agree to deliver the performance of the associated index (minus a small spread), including capital gains and dividends, in exchange for the value of the performance generated by a pool of physical securities held by the ETF. This allows the ETF to mirror the performance of an index without having to own the actual securities. This can be advantageous when it is difficult or expensive to trade in certain markets or sectors.

Actively Managed

This category of ETFs, including Mackenzie Active ETFs, allows managers to apply their own expertise in overseeing portfolio construction and trading decisions, similar to actively-managed mutual funds. While the ETF will have a benchmark index, its managers will generally attempt to outperform that index’s returns rather than simply match it.

The main difference between actively-managed ETFs and mutual funds is that actively-managed ETFs are priced and traded intraday, while active mutual funds can only be purchased or sold at their NAV after the market closes.

Myth 8: ETFs are so simple, there’s no need to seek professional advice

Reality:

One core principle of investing is that asset allocation, more than individual stock selection, is a main driver of returns. Investors should work with an advisor to design an appropriate asset allocation and then choose the appropriate individual investments.

Additional resources

Commissions, management fees, brokerage fees and expenses may all be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this web page (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.