One of the first decisions many investors make is regarding the asset allocation of their portfolio: this is typically the percentage of equities they’ll hold versus the percentage of fixed income assets. Asset allocations are set up to reflect the investor’s risk tolerance, investment objectives and investment timeline.

If you’re approaching retirement, you’ll likely have a larger percentage of bonds. If you’re in your 30s, you’re more likely to have a higher percentage of stocks.

Asset classes perform differently in various market environments, so having an appropriate strategic asset allocation mix can help investors stay invested during constantly changing market conditions. Having an optimal asset allocation is only the starting point, however. To have the best chance of achieving their investing goals, rebalancing is equally essential.

How rebalancing works

Rebalancing is the process investors use to buy and sell various asset classes to maintain the asset allocation mix over time. It can be done at the asset class level (for example, equities versus fixed income), the sub-asset class level (for example, US fixed income versus Canadian fixed income) and at the individual security level (for example, single company shares).

As markets change, the value of assets can rise and fall and, over time, this can lead to the original asset allocation becoming skewed. Regular rebalancing helps return your portfolio to its original target allocation and risk level.

It does this by minimizing the risks involved if your portfolio becomes too concentrated or if there are unintended bets to specific asset classes. It helps you to control your behaviour and minimize emotional decisions that could lead to buying high and selling low.

It’s all about the long term

While rebalancing may lead to short-term underperformance during extended periods of share price increases, overall, it provides you with a smoother, less stressful investment experience, which will put you in a better position to achieve long-term savings goals.

Rebalancing forces you to remain disciplined and bring your portfolio back to its original allocation mix by selling the top-performing asset classes and reallocating the proceeds to the worst performers. This helps portfolios to remain more consistent when markets take a tumble by buying more fixed income during bull markets and participating in the upside by buying more equities during bear markets.

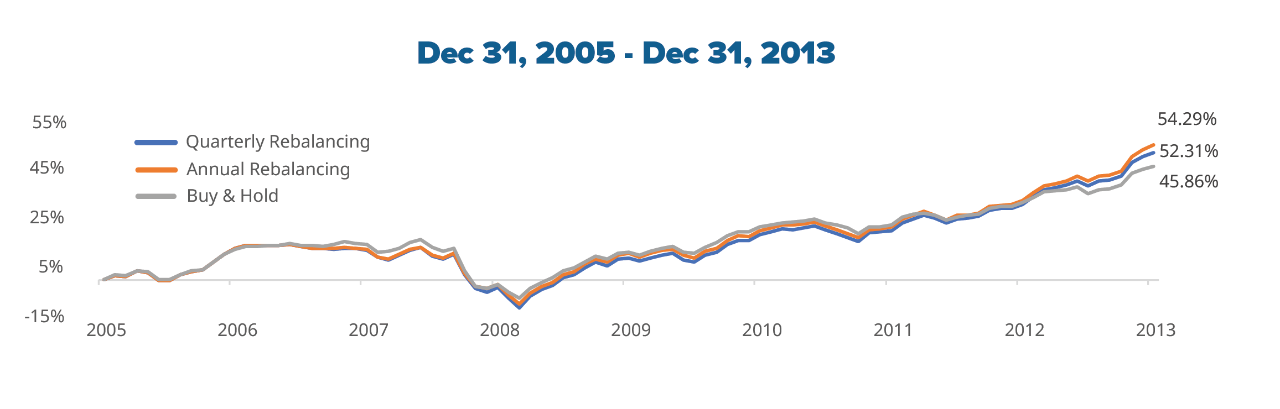

To illustrate the potential impact of rebalancing, we analyzed three hypothetical portfolios (buy and hold, quarterly rebalancing and annual rebalancing) with a target asset mix of 60% equities and 40% fixed income, during the most recent extended bear market.

This includes the period before, during and after the 2008 financial crisis. The annual and quarterly rebalancing strategies outperformed the buy-and-hold approach by more than five percentage points in total returns, while also providing better risk-adjusted returns.

ETFs that do the rebalancing for you

Mackenzie’s asset allocation ETFs deliver low-cost, broad global diversification. They already have strategic asset allocation built in and they have a scheduled, disciplined rebalancing process. This helps investors stay on track by maintaining the original asset allocation that fits their risk level.

Our suite of asset allocation ETFs:

Mackenzie Conservative Allocation ETF (MCON)

Mackenzie Balanced Allocation ETF (MBAL)

Mackenzie Growth Allocation ETF (MGRW)

These ETFs are designed for investors with different risk profiles, so every investor can incorporate one of these into their portfolio and never have to worry about having to rebalance them — we do all of that for you.

You can find out more about asset allocation ETFs in our article, Achieving comprehensive diversification, and you can also read more about the benefits of rebalancing in our white paper, Rebalancing your asset allocation mix.

To discuss rebalancing and asset allocation, please contact your financial advisor or your Mackenzie Sales Team.

Commissions, management fees, brokerage fees and expenses all may be associated with Exchange Traded Funds. Please read the prospectus before investing. Exchange Traded Funds are not guaranteed, their values change frequently and past performance may not be repeated. The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of February 15, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this communication is intended for informational purposes only and does not constitute legal advice or an opinion on any issue. Although we endeavour to ensure its accuracy, we assume no responsibility for any reliance upon it. There should be no expectation that the information will be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.