Help Canadians Give: Donor-Advised Funds as a Philanthropic Strategy

Help Canadians Give: Donor-Advised Funds as a Philanthropic Strategy

March 28, 2018

Keith Sjogren

Senior Consultant And Managing Director, Consulting Services, Strategic Insight

Carol Bezaire

Vice-President, Tax, Estate & Strategic Philanthropy, Mackenzie Investments

In 2015, a little over 6 million Canadians reported making a contribution to a Registered Retirement Savings Plan. Many of those people, whose contributions averaged $6,470, took advice from a qualified financial advisor before making their investment choices. In the same year, 5.5 million Canadians reported making at least one gift to a registered charity. Most of those people made their gifts without taking any advice other than from family and friends.

Over the past decade, millions of Canadians have chosen to support the work of the almost 86,000 charitable organizations in Canada. At the same time, regulations governing charities and the manner in which gifts can be made are changing and becoming more complex. The obvious questions are why don’t more Canadians seek advice before making donations, and how can a financial advisor help their clients implement their charitable giving decisions?

The Mackenzie Charitable Giving Program, structured as a donor-advised fund, provides financial advisors with a straightforward way in which to assist their clients in making and managing their personal giving programs. This whitepaper will provide important information on the charitable sector, donor-advised funds and the benefits being realized by advisors as they expand their wealth guidance to include personal philanthropy.

Funding the Charitable Sector

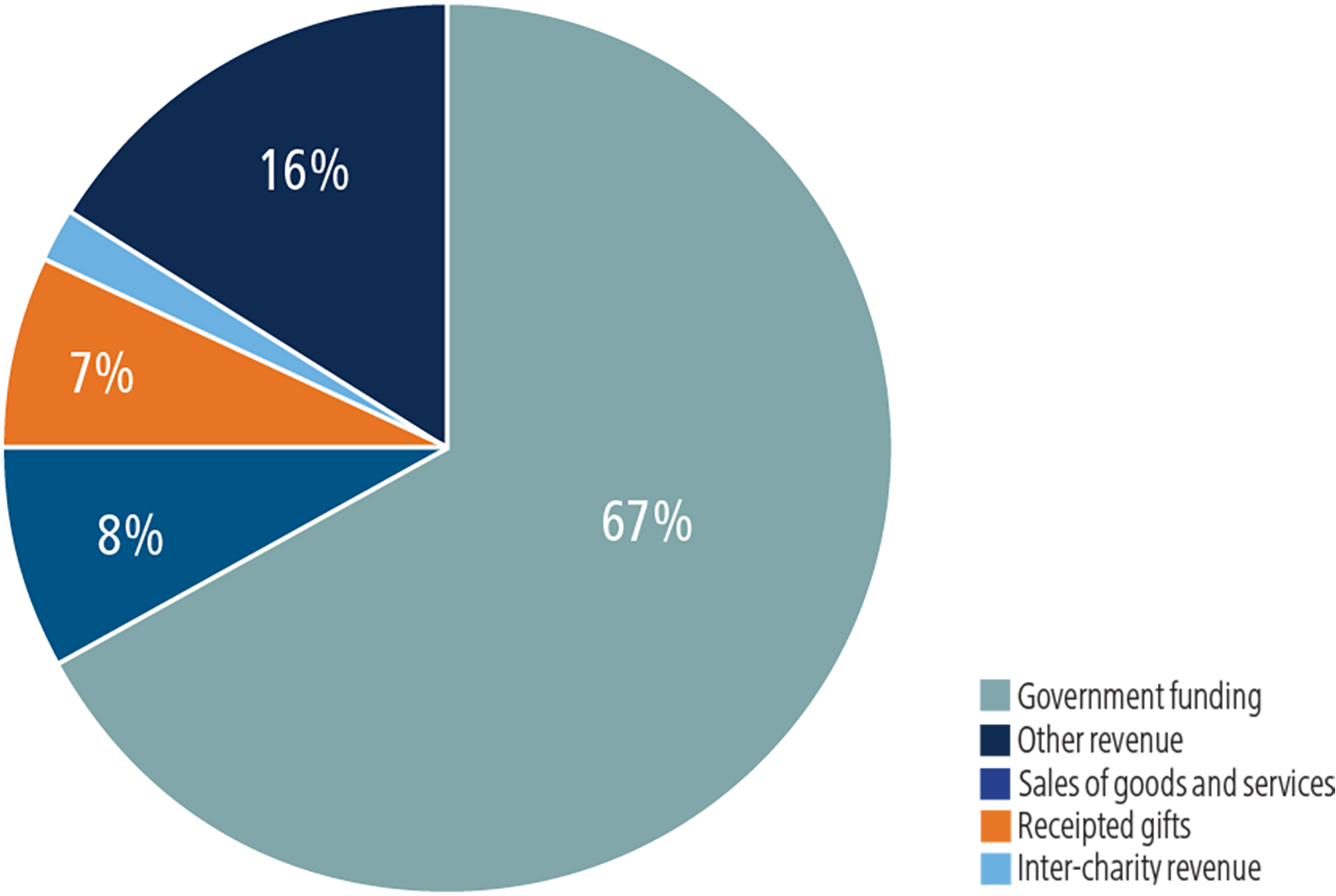

Figure 1 Key Sources of Funding for Canadian Charities

The Canadian not-for-profit sector is a significant contributor, not only to the well-being of thousands of Canadians each day but also to the economy. In 2015, the year for which the most current data is available, Canadian charities reported $251 billion in total revenue and $241 billion in total expenditures. At the end of the same year, registered charities employed 1.7 million people, which represents 12% of employed Canadians.

While various levels of government contributed the bulk (67%) of revenue, the support provided by generous Canadians was vital to the health of the sector. Gifts to charities by individuals, families and corporations in 2015, for which tax receipts were issued, totaled $16.5 billion. With funding from all levels of government becoming less reliable, charities are becoming increasingly dependent on individual gifts and revenues from other sources.

Family and individual donations are far more important to charities with annual revenue of under $500,000 than they are to large charities with revenues over $5 million. In 2015, large charities received 96% of all government funding with only 6% of their total revenue coming from families and individuals.

Individual and Family Donations

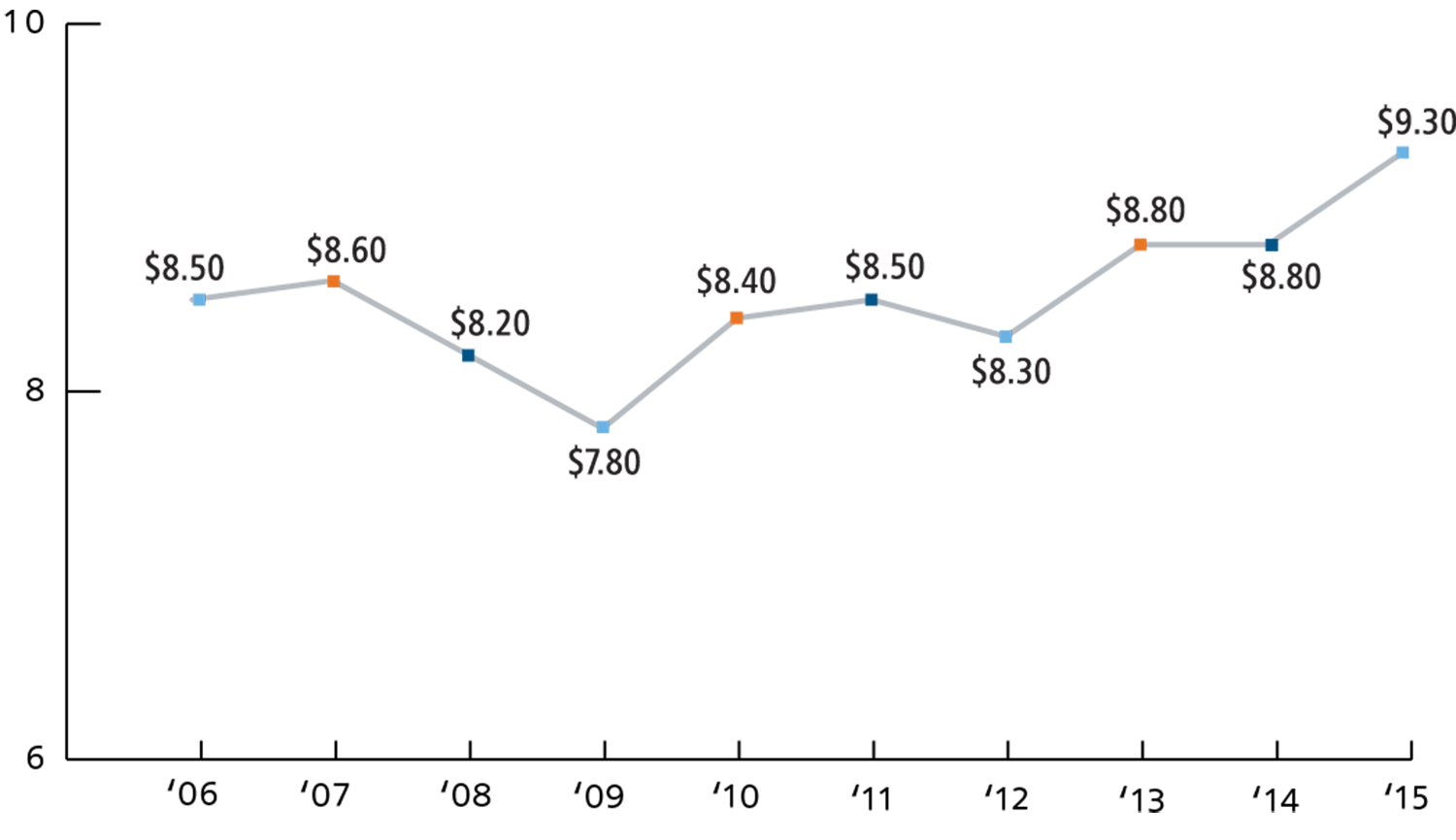

Figure 2 Total Tax Receipted Donations ($ Billions)

Using data published by Canada Revenue Agency (CRA), individuals filed tax receipts reflecting charitable gifts of $9.3 billion in 2015. Five years earlier, the amount was $8.4 billion. Despite a period of mixed economic fortunes caused by low energy and other commodity prices, donations by Canadians rose at a compound annual growth rate of 2.2%. Looking back as far as 2006, while there has been an increase in the overall level of giving, adjusting the donation totals for inflation indicates that the value of reported donations has fallen from $8.5 billion in 2006 to $8.1 billion in 2015.

Although total personal donations have risen, the number of families and individuals claiming a charitable deduction has seen a decline. In 2010, 43.7% of families reported making donations to CRA. By 2015 the share had fallen to 39.7%. A review of individual tax filer data for the same five-year period underlines the trend with the share of individual tax filers claiming a deduction declining from 24.0% to 21.0% over the period.

Influences on Giving

Other than the overall state of the economy, giving patterns by Canadians emphasize four fundamental drivers; age, gender, financial well-being and geography. The older people get the more generous they become. For example, in 2015, 25.9% of Canadian tax payers between the ages of 40 – 49 claimed an average charitable deduction of $1,314. Compare this to the average deduction of $1,882 claimed by 28.1% taxpayers in the 65 – 74 cohort. The Canada Revenue Agency data also shows that in 2015, on average, male taxpayers who claimed a charitable deduction donated almost $700 more than female taxpayers. But that gap has been narrowed in recent years as women’s income growth has outpaced that of men in Canada. Furthermore, survey data published by the Association of Fundraising Professionals indicated that women are more likely to donate than men.

While age and gender are factors in determining the most likely donors, the single biggest influence is financial wellbeing. This becomes apparent when comparing taxpayer segments for those reporting incomes in excess of $100,000. Canadians earning between $100,000 and $150,000 are twice as likely to claim a charitable deduction as the average tax payer although the amount they claim is only marginally above the average of $1,629 of all claimants.

At the top of the income pyramid are those families and individuals with incomes of over $250,000. Two-thirds of individuals at that income level claimed a charitable deduction in 2015 (compared to an overall average of one fifth). This, in itself, is impressive although what is more telling is the fact that individuals in this income group gave, on average, $14,809 – nine times the national average – and accounted for 28.5% of all donations claimed. It is also worth noting that, while the total number of families with incomes in excess of $250,000 increased by a compound annual growth rate (CAGR) of 8.4% between 2006 and 2015, the CAGR of donating families in that income group rose by only 7.2%.

Leading donors – defined by frequency and/or by the level of annual donations – are more likely to cite issues such as the effectiveness of charities and even the legitimacy of charities than other donor segments. This donor segment are also far less likely to identify financial pressures as a reason not to donate. Furthermore, two-thirds of leading donors indicate a high level of comfort with their current level of giving with only one in five believing that they could do more.

A fourth influence on individual donations is geography. In 2015, in terms of the percentage of families and individuals claiming a charitable deduction, Manitoba was the clear winner. Viewed in terms of absolute generosity, Manitobans were ranked third, behind British Columbia and Alberta, the most generous province. If generosity is viewed at the municipal level, family and individual donors in Toronto and Calgary were the leaders with average gifts well above the national average.

By examining income and provincial data, it is possible to narrow the search for the provinces with the greatest potential for giving. Assuming that families with total annual income in excess of $150,000 are the most likely to be attracted to a donor-advised fund program, it is evident that on a relative basis the two most western provinces – British Columbia and Alberta – represent the highest potential, followed by Ontario and Manitoba. Obviously, from an absolute perspective, Ontario is the leader although Albertan families claimed approximately $1 billion in donations in 2015.

Why Canadians Give

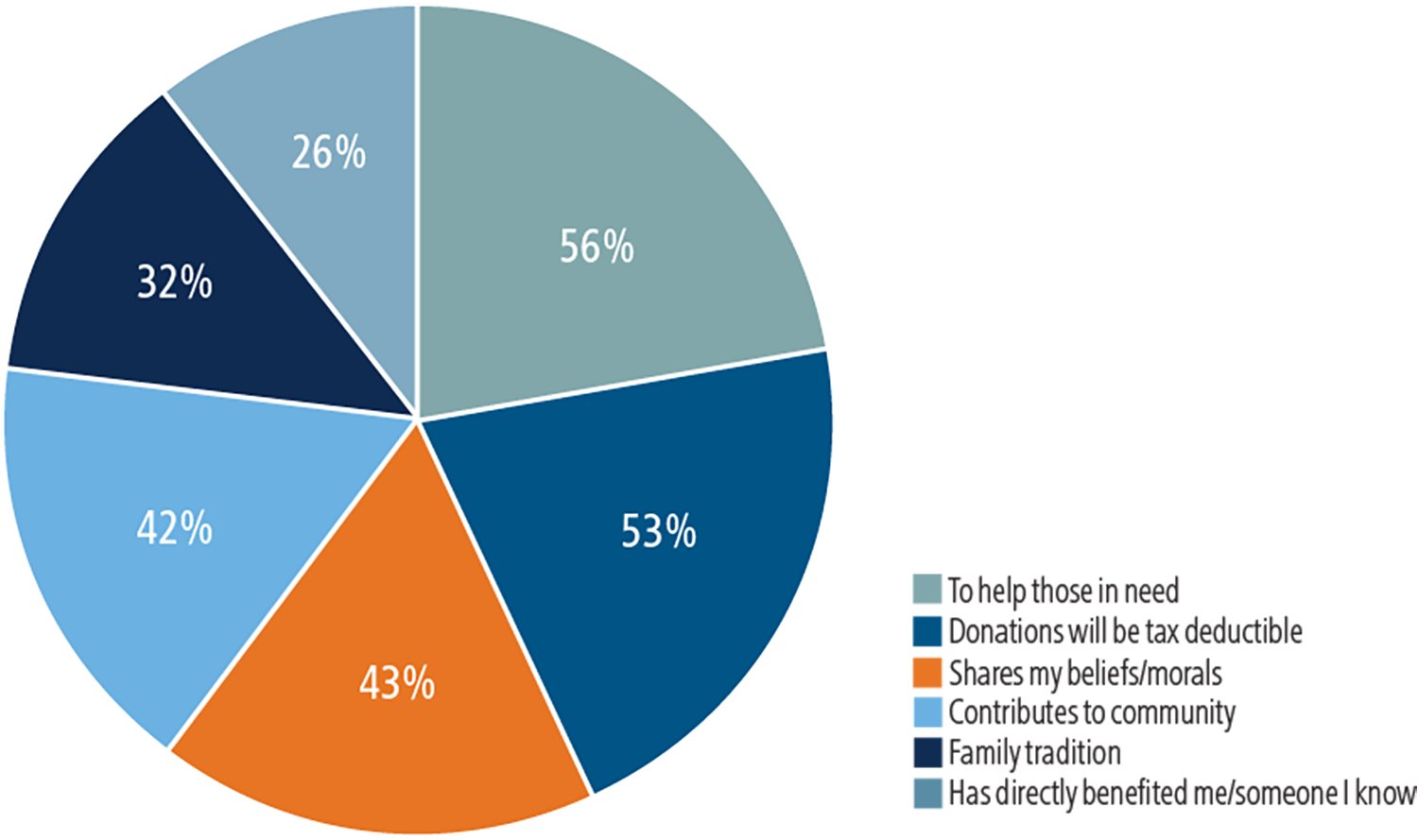

Figure 3 Donor Motivations

Surveys of Canadian donors undertaken in both 2013 and 2015 indicate that the leading reasons for donating is a desire to help those in need and a sense that it is the right thing to do. In addition, people are motivated to give to a cause or charity that may have directly affected or benefited the donor or a member of their family. Others are influenced by religious beliefs or family traditions.

Health, social services and religious causes have been perennial leaders in terms of the recipients of personal donations. A recent survey by Cygnus Applied Research indicated that 77% of respondents supported health-related causes, well ahead of the numbers that supported social services (59%) and religious organizations (40%).

On the other side are Canadians that neither donate nor volunteer primarily through a lack of financial resources or a lack of time. Some also demonstrate a lack of trust in the charitable sector or claim, with some validity, that they have not been approached to donate. In regard to the latter, a 2015 survey undertaken by Ipsos for the Association of Fundraising Professionals, indicates that the number of Canadians approached by charities declined from 70% in 2011 to 53% in 2015.

Almost one-third of Canadians feel that they should do more to support various causes and specific charities and financial advisors are well positioned to provide counsel as to how this objective can be achieved. Generally, donors who increase their level of giving are responding to a special request (37%), recognizing efforts made by a particular charity (35%) or, importantly, providing support to the relief efforts associated with an emergency (41%).

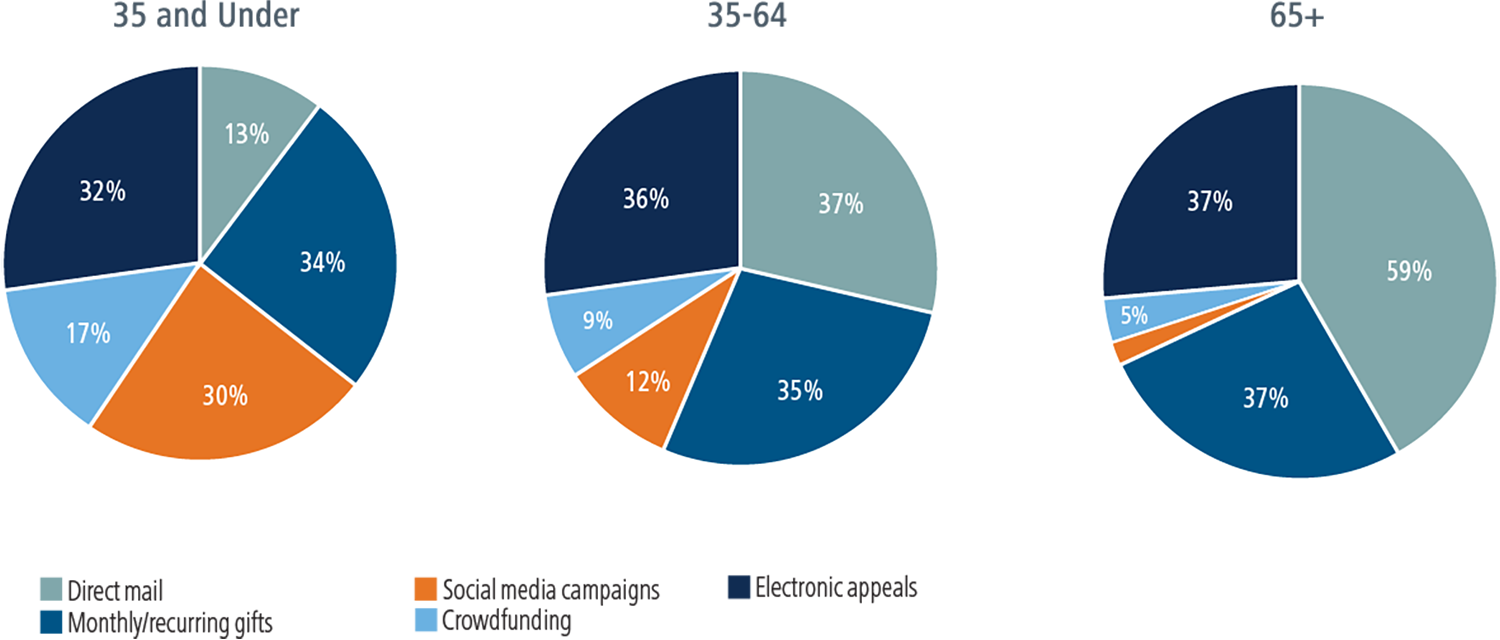

How Canadians Give

Canadian donors have no shortage of ways to support charitable organizations. Many respond to solicitations at grocery store checkouts, others provide donations at special events, while a number prefer a more structured approach through a multi-year pledge. Different age cohorts have dissimilar reactions to the various types of donation methods. For example, millennials are very likely to donate online rather than make a donation through mailing a cheque or using a credit card. At the other end of the age spectrum, those of age 65 or older, are comfortable making a donation as the result of a door-to-door canvas or an appeal through an obituary, methods that have limited appeal to younger donors.

Figure 4 How Canadians Give (by age cohort)

Giving mediums are, to some extent, governed by wealth. For example, the use of private foundations or gifts to endowment funds tend to be reserved for those with high incomes and extensive accumulated wealth due to the complexity and cost. These types of structures provide for long-term support to one or more causes and often require advice either from a representative of the charity or a financial advisor. An increasingly popular vehicle for affluent donors is a donor-advised fund. The balance of this white paper is devoted to providing information and insights into these structures that are making an impact on the giving habits of Canadians.

What are Donor-Advised Funds?

A donor-advised fund (DAF) is a distinct fund or account established within the structure of a registered charity into which a donor makes a single or series of irrevocable gifts. The donor, through an agreement with the charity, has the ability to advise the charity how he/she would like all or part of the balance in the fund to be spent.

In view of the fact that the donor has made a gift to the charity, the donor cannot direct how the funds are utilized but can make recommendations. In most cases, however, the donor’s wishes are followed by the charity with the exceptions being cases where the purpose of the grant is inappropriate or where the status of the charity is in question.

Donor-advised funds are offered by a variety of charities including community foundations, some hospital foundations, foundations established by financial institutions as well as other organizations who work with financial advisors to enable them to help their clients implement charitable giving strategies.

Donors to DAFs are able to donate cash, securities, life insurance proceeds and other types of financial assets. Donations can also be made through a bequest in a will. In the U.S. the largest DAF sponsor has enabled donors to contribute Bitcoin units to their DAF account. Donations are not restricted to the account holder – which can be an individual, a family or a corporation – and friends and family members, for example, can also make contributions either at the time the DAF is established or during the lifetime of the DAF.

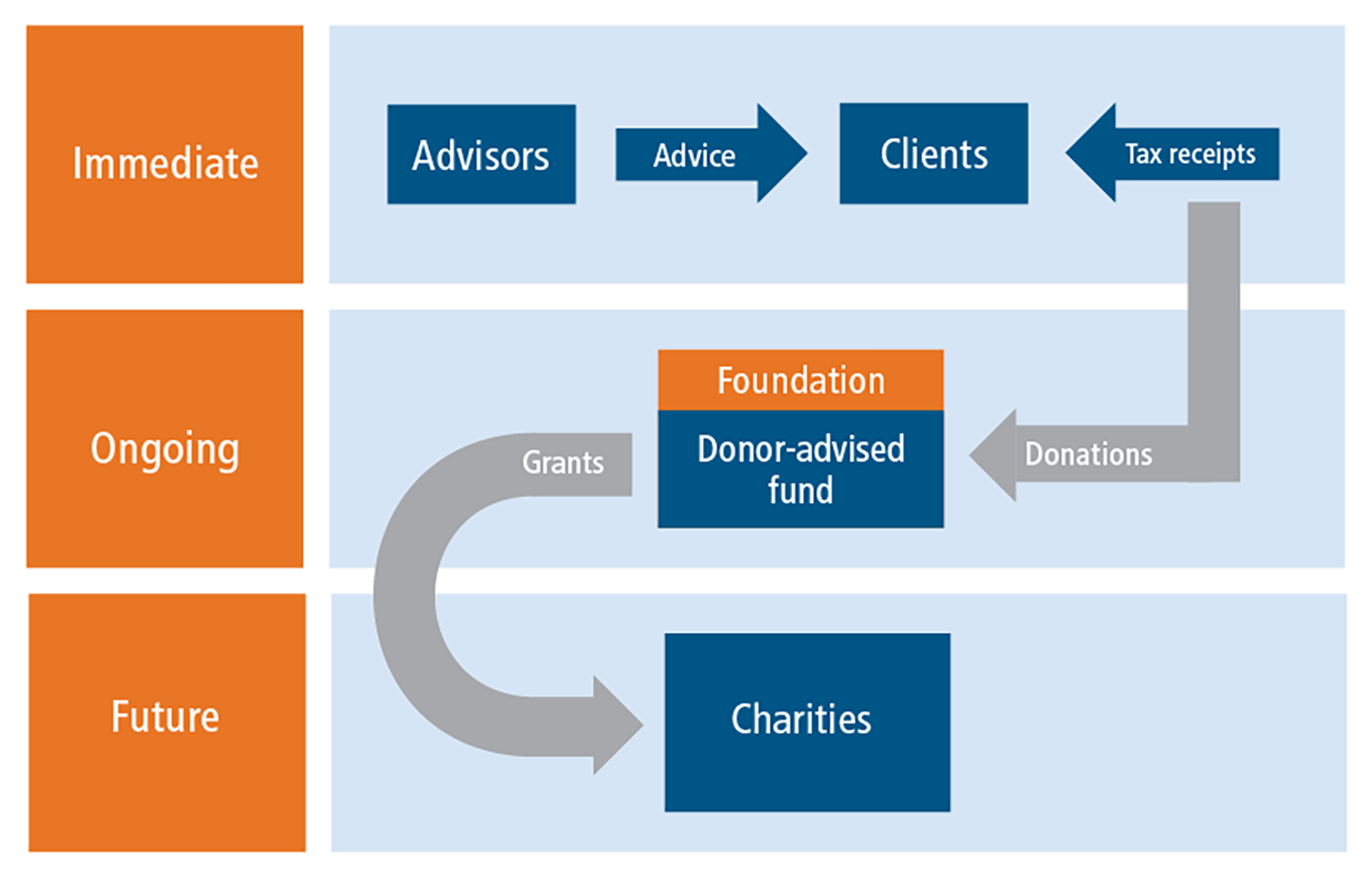

Figure 5 The Structure of Donor-Advised Funds

The major benefit of DAFs is the opportunity they provide to donors seeking to develop a strategic approach to both charitable giving and personal tax planning. Such funds are also a relatively inexpensive and less burdensome alternative to the establishment of a private foundation. Many DAFs also enable individual donors to continue to work with their investment advisors after the donation has been made and to benefit from the counsel of their advisor in terms of both the investment and the nature and timing of gifts made from the account. Finally, as the grants are made by the host foundation, the original source of funding need not be revealed to the recipient charity, a feature which relieves donors from being solicited for additional gifts.

One of the challenges is that minimum initial donations are above the average annual donation of all but the highest income groups. Typically, DAFs at community foundations require a minimum initial deposit of $5,000 while foundations set up by financial institutions have even higher minimums. As a result, the appeal of the product tends to be limited to higher income and more affluent segments. The ability of a family to establish a DAF and to pool their donations is a way to meet the DAF minimum size requirement.

Currently, there are no specific regulations that govern the use of DAFs other than those imposed on account holders by the host foundation. The foundations, themselves, are subject to a disbursement minimum of 3.5%. In other words, the foundation that supports the Mackenzie Charitable Giving Program is required to disburse 3.5% of assets during the year. In practice, disbursements from foundations established by financial institutions to support their customers have disbursement rates close to 20%.

How Big is the Market?

Although there is no easy way to estimate the total size of the DAF market in Canada, research and analysis undertaken by Strategic Insight suggests that assets held in DAFs by 18 special purpose foundations set up to support the work of financial advisors amounted to $1.5 billion at the end of 2016. The ten largest foundations account for approximately 95% of these assets.

The Mackenzie Charitable Giving Program is now the third-largest of its type with a total of $221 million in DAF balances at year-end 2016 representing a 15% share of this market sector.

Top Ten Donor-Advised Fund Foundations used by Financial Institutions ($ Millions)

| Total Assets 2016 | Donation Received 2016 | |

|---|---|---|

| Charitable Gift Funds Canada Foundation (RBC) | $384.00 | $73.30 |

| Private Giving Foundation (TD) | $297.30 | $41.00 |

| Strategic Charitable Giving Foundation (Mackenzie and IG) | $221.40 | $32.30 |

| Aquaduct Foundation (Scotia) | $196.60 | $34.70 |

| Benefaction Foundation (CIBC) | $84.90 | $31.70 |

| Tides Canada | $68.40 | $4.10 |

| NWM Private Giving Foundation | $61.90 | $4.60 |

| CHIMP Foundation | $52.70 | $9.08 |

| Vancity Community Foundation | $51.60 | $4.80 |

| Canada Gives | $25.50 | $4.50 |

Community foundations, the other major provider of DAF services in Canada, are not required to separate DAF assets from other accounts in their financial reporting. However, information that is reported by leading community foundations, suggests that DAFs are increasingly popular. Estimates developed by Strategic Insight indicate that while the number of DAFs in place at community foundations may be less than those at special-purpose foundations, total assets may be similar. Accordingly, it is reasonable to estimate that a total of at least $3.5 billion is now held in DAFs in Canada.

While this is an impressive number, it is dwarfed by the number and size in the United States. At the end of 2016, total assets held in DAFs available for distribution to charities was $78.6 billion. Five-year growth in Canada has equalled that in the U.S. with assets in both countries growing at a compound annual growth rate of close to 20%. In 2016, the percentage of charitable donations flowing into DAFs was approximately 8.4% in the U.S and an estimated 5.9% in Canada. The difference between the two countries is represented by the maturity of the sector in the U.S. and higher level of activity by U.S. financial advisors that support foundations sponsored by leading investment dealers and fund companies.

The Outlook

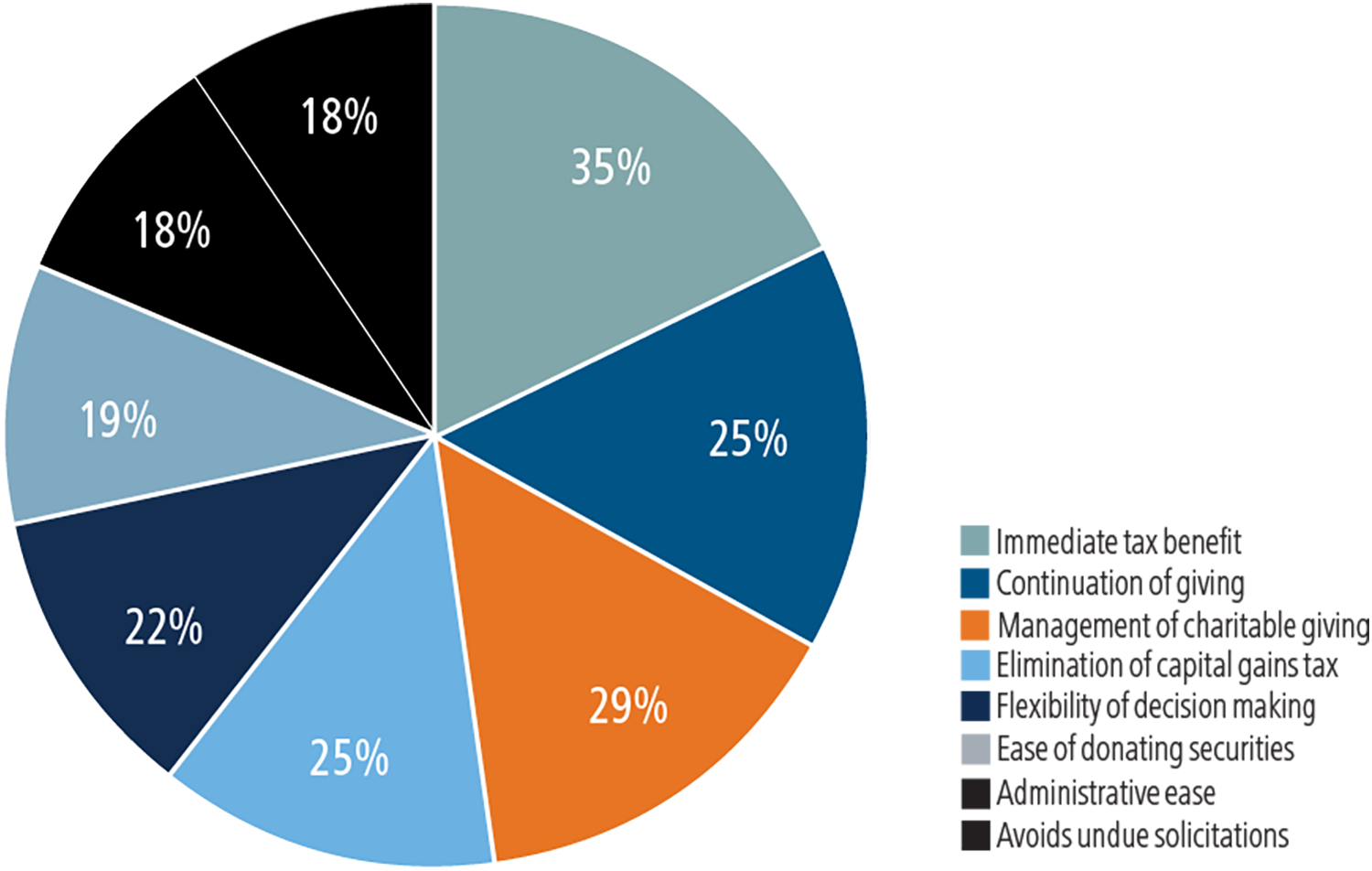

Figure 6 Benefits of Donor-Advised Funds (as cited by DAF holders)

The overall outlook for the further growth of DAFs in Canada is positive even though the growth rate may ease as it has in the U.S. Drivers of this projected growth include the increased awareness of DAFs and the broader access available to Canadian financial consumers that use professional advisors; the move away from financial planning that is focused on retirement to a more comprehensive and holistic assessment of family wealth; and the demographic shift that places greater wealth in the hands of those most likely to give to charities.

It is not only awareness of the vehicle itself but familiarity with the distinct benefits that will fuel the growth of the use of DAFs. In addition to the benefits mentioned earlier in this paper, such as the immediate tax benefit, current users of DAFs cite the administrative simplicity, such as the ability to make multiple donations from a single source; the ability to grow assets dedicated to charitable purposes through the investment of those funds; the ease of donating securities in a manner that eliminates capital gains tax; and the perpetual nature of the account. Users also made reference to the fact that the account can remain open and active following the passing of the original source of funds. In other words, it becomes a family not an individual initiative.

Even though the DAF market in Canada is relatively underdeveloped, it is evident that not all DAF sponsors are growing at the same pace. Those sponsors that are directly associated with large financial advisor salesforces have a greater ability to draw attention to the DAF opportunity than may be the case for sponsors that rely on working with small investment firms and individual advisors.

DAFs and Charities

The recent success of DAFs has also produced some critics although their voices are muted when compared to those who see DAFs as encouraging and enabling philanthropy. The primary criticisms of DAFs are the belief that they attract money away from charities without stimulating new charitable giving; that they are being used mainly for tax planning purposes; and that advisors have no incentive to encourage their clients to put the funds to work in the charitable sector.

There is no clear evidence that the emergence of DAFs have stimulated the flow of new funds to charities, although the gifting rates of established DAFs indicate that assets are not being held for undue periods of time and that, through the DAF mechanism, account holders are developing a more strategic approach to philanthropy. Additionally, DAFs may offer charities a more predictable source of funding owing to the ability of donors to set up standing grant recommendations to one or more charities each year.

DAFs and Advisors

Irrespective of the vehicles used for making charitable gifts, there is evidence that both clients, particularly high net worth clients, and their advisors benefit from a discussion about planned giving or other types of strategies, including the use of DAFs. As discussed in the recently-released Mackenzie white paper on the High Net Worth, conversations around philanthropy build relationships and help position advisors as objective wealth advisors not merely a channel for investment.

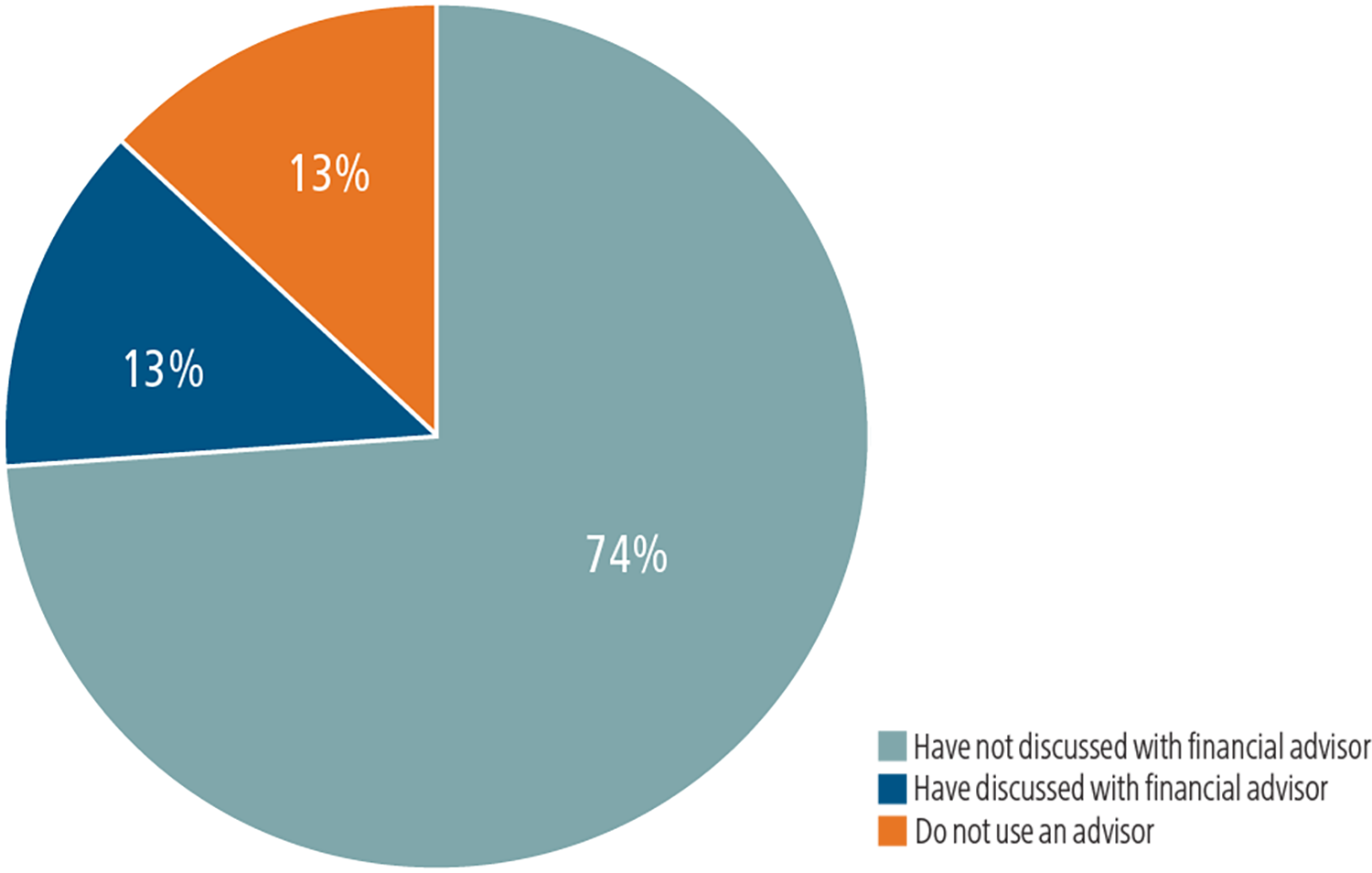

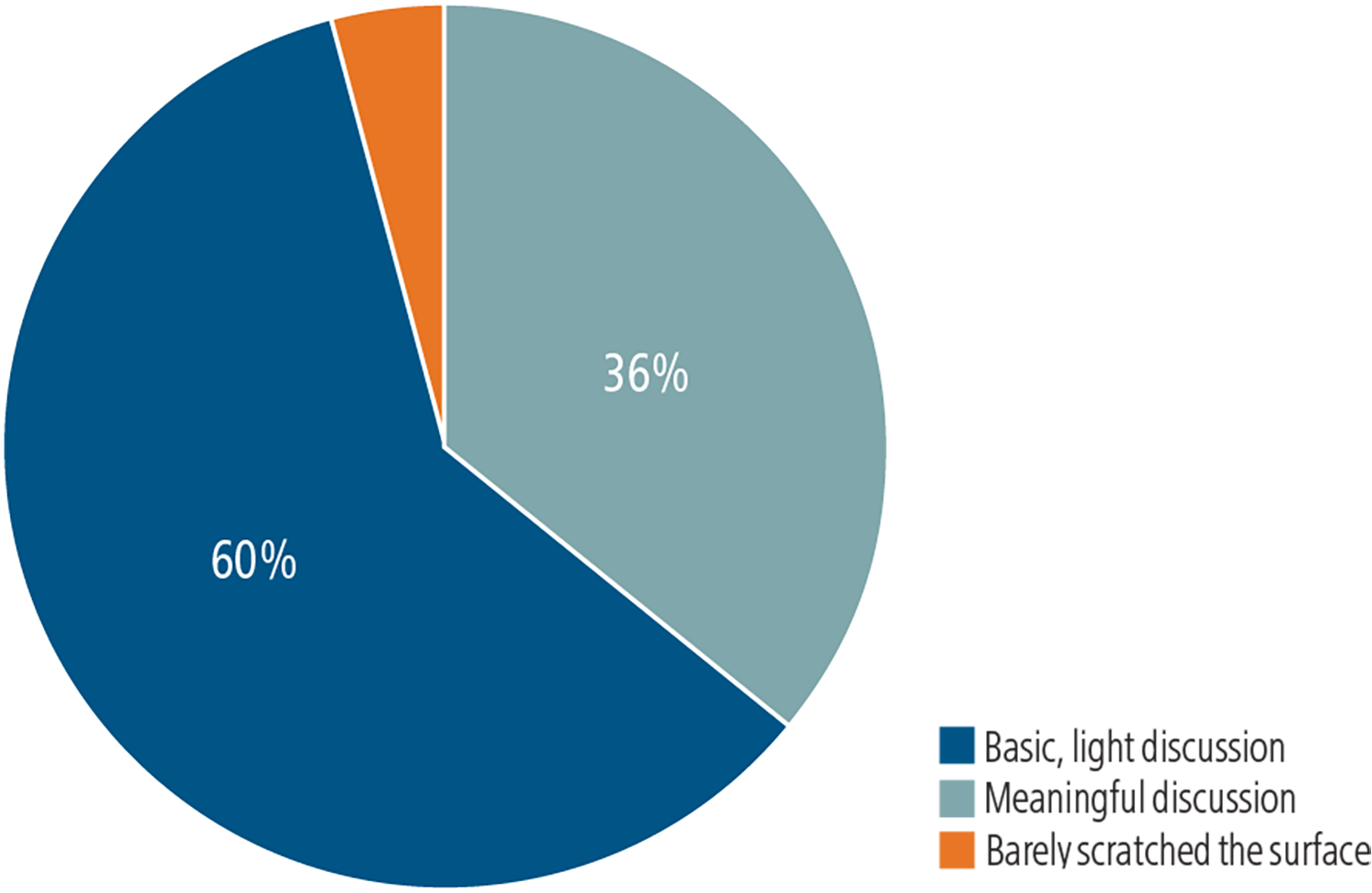

Many advisors are reluctant to raise the topic with clients because of a concern about a lack of technical expertise on the topic, reservations about raising issues of a personal rather than a financial nature or, inappropriately, through a concern that they may be inviting the client to move assets from an investment account into a foundation or directly to a charity. Recent surveys of high net worth donors indicate that 87% of donors claim to never have had a conversation about giving with their financial advisor and, of those that did have a conversation, only 36% suggested that they were meaningful and useful discussions.

Figure 7 Philanthropy Discussions with Financial Advisors (HNW donors)

Figure 8 Nature of Philanthropy Discussions with Financial Advisors (HNW that have discussed)

The same study pointed to the fact that 95% of those advisors that raised the topic of philanthropy with their affluent clients believed that it strengthened their relationships and 76% of the affluent clients agreed with that point of view. Without question, advisors that are positioned to both discuss and implement charitable giving strategies establish a competitive advantage over other investment professionals.

Giving to charities is an essential element in the financial plans for upscale and high net worth Canadians. Tax data shows that the majority of high income households give to charities on an annual basis and that, in some age and income groups, more Canadians give to charity than invest in retirement programs. Discussions with donors or potential donors can take place during regular investment reviews or when the general topic of estate planning is on the agenda. As the high net worth community in Canada ages and represents an increasing share of overall personal wealth, there is more interest in discussing wealth transfer, such as charitable bequests.

As the number of DAFs increases and the awareness of DAFs by financial advisors also increases, advisors who ignore these developments will expose themselves to a competitive disadvantage and place relationships at risk. All the major banks now have programs in place that can be accessed by their financial advisors, be they branch-based, full-service brokerage advisors or investment counsellors. Independent advisors will need to recognize the importance of remaining contemporary and expanding their value proposition beyond investments and insurance.

Interviews with Advisors

During the research for this white paper, Strategic Insight was given the opportunity to speak with three financial advisors that have made use of the Mackenzie Charitable Giving Program. The discussions provided sound ideas for all advisors to consider in dealing with clients who are active donors or starting a conversation about planned giving.

While each of the advisors mentioned different ways to discover the giving habits of their clients, two methods were identified as being both straightforward and non-invasive. First, as financial or estate plans were being developed or refreshed the topic of personal philanthropy is an obvious one to raise, particularly with older clients and those who have accumulated sizeable wealth. Second, a review of personal tax returns will provide information on the current as opposed to anticipated generosity.

Once the topic of charitable giving has been raised, advisors recommend that the various ways of giving be discussed with the client. These would include gifts of securities, the use of life insurance, multi-year pledges and the establishment of a donor-advised fund with a registered charity such as the Strategic Charitable Giving Foundation. The advisors that were interviewed unanimously agreed that there was very little awareness of donor-advised funds among eligible clients and that advisors need to be prepared to provide detailed explanations as to how these accounts work and the various tax and administrative issues associated with establishing such an account.

As one advisor mentioned the typical reaction from a client is “do you mean to say that if I put in $100,000 today, I get a tax receipt for the full amount even though I can decide down the road where I want to give it?” This combination of the immediate tax benefit and the ability to defer decision making were acknowledged as the most attractive benefits in the mind of the client. Another advisor mentioned how important it is to ensure that the client understands that they “donate but still advise”.

The advisors agreed that discussions around charitable giving definitely broadens the range of financial issues to be covered. Raising the issue also provides an opportunity to discuss a matter of interest to the client’s family and one that many families seem reluctant to raise with their financial advisor.

The Mackenzie Charitable Giving Program, one of the fastest growing in Canada, is well supported by in-house experts readily available to assist financial advisors and their clients. As one advisor suggested, “This is a very important aspect of looking out for their clients and looking out for the rest of the world too.”

Ideas for Advisors

DAF programs, such as the one offered through Mackenzie, offer educational materials, access to tax and estate planning experts and, importantly, the ability of the advisor to remain involved with the client and her/his family as their philanthropic activities expand.

Here are some tips on incorporating charitable gift planning into your practice:

- Review your client’s tax filings to determine if they give to charity on a regular basis.

- Introduce the topic of charitable giving in financial planning and estate planning conversations.

- Move from a high-level discussion to the provision of information on giving vehicles.

- Share stories about your own charitable activities and those of other clients.

- Demonstrate the overall financial and tax aspects of giving, particularly through DAFs, such as the gifting of securities and the ability of money set aside for charities to grow while held in a DAF.

- View it as a way of involving other members of the family in the relationship. DAFs are often held in the name of parents and their children.

- Hold seminars for clients towards the end of the year, the time when most gifts are made.

Summary

Canadians are generous and the annual amount donated by Canadians to charities has been increasing on an annual basis. At the same time, the ways in which Canadians give to charitable causes and organizations has changed and will continue to change as technology becomes an essential element in how Canadians manage their financial affairs.

Donor-advised funds, particularly those linked to financial institutions such as banks and investment companies, have established themselves as a practical, straightforward and tax-effective way to manage the philanthropic activities of individuals and families. In recent years, assets held in donor-advised funds have grown annually at 20% or more despite an equally high rate of withdrawals made to fund charitable gifts.

The experience in the United States and the recent experience in Canada suggests that these vehicles will remain at the forefront of charitable giving. Charities themselves are becoming more familiar with donor-advised funds and are finding that the continual stream of grants are a complement to their usual fundraising activities.

As more investors become aware of the opportunity and benefits represented by donor-advised funds, it is incumbent upon financial advisors to improve their own knowledge of charitable giving techniques. Meeting the varied and sometimes complex needs of upper-end clients is critical to maintaining relationships. Offering donor-advised funds as a solution to the charitable giving dilemma faced by many individuals and families will strengthen relationships and allows advisors to remain associated with the assets until they are released to a charity.